2025-04-02

WASHINGTON (AP) — Weak population gains and increased government spending will result in slower overall economic growth over the next 30 years, the nonpartisan Congressional Budget Office said Thursday.

The CBO’s latest long-term budget and economic outlook report — for a timeframe that spans 2025 to 2055 — projects publicly held debt to reach 156% of gross domestic product, or GDP, in 2055. That’s down from the agency’s March 2024 long-term budget projection, which said publicly held debt would be equal to a record 166% of American economic activity by 2054.

However, that’s not necessarily a positive.

The mix of slower population growth and unfettered spending will also result in weaker economic growth over the next three decades than what the CBO projected last year. Lower birthrates also mean that the United States is becoming more dependent on immigrants working to sustain growth.

“Without immigration, the U.S. population would begin to shrink in 2033,” the CBO report states.

The report assumes that all the laws set to expire, including certain provisions of Trump’s 2017 tax cuts, will expire. But the White House and Republican lawmakers have said that the tax cuts will be renewed and potentially expanded, as well as suggesting reductions in government spending and an increase in revenues by taxing imports.

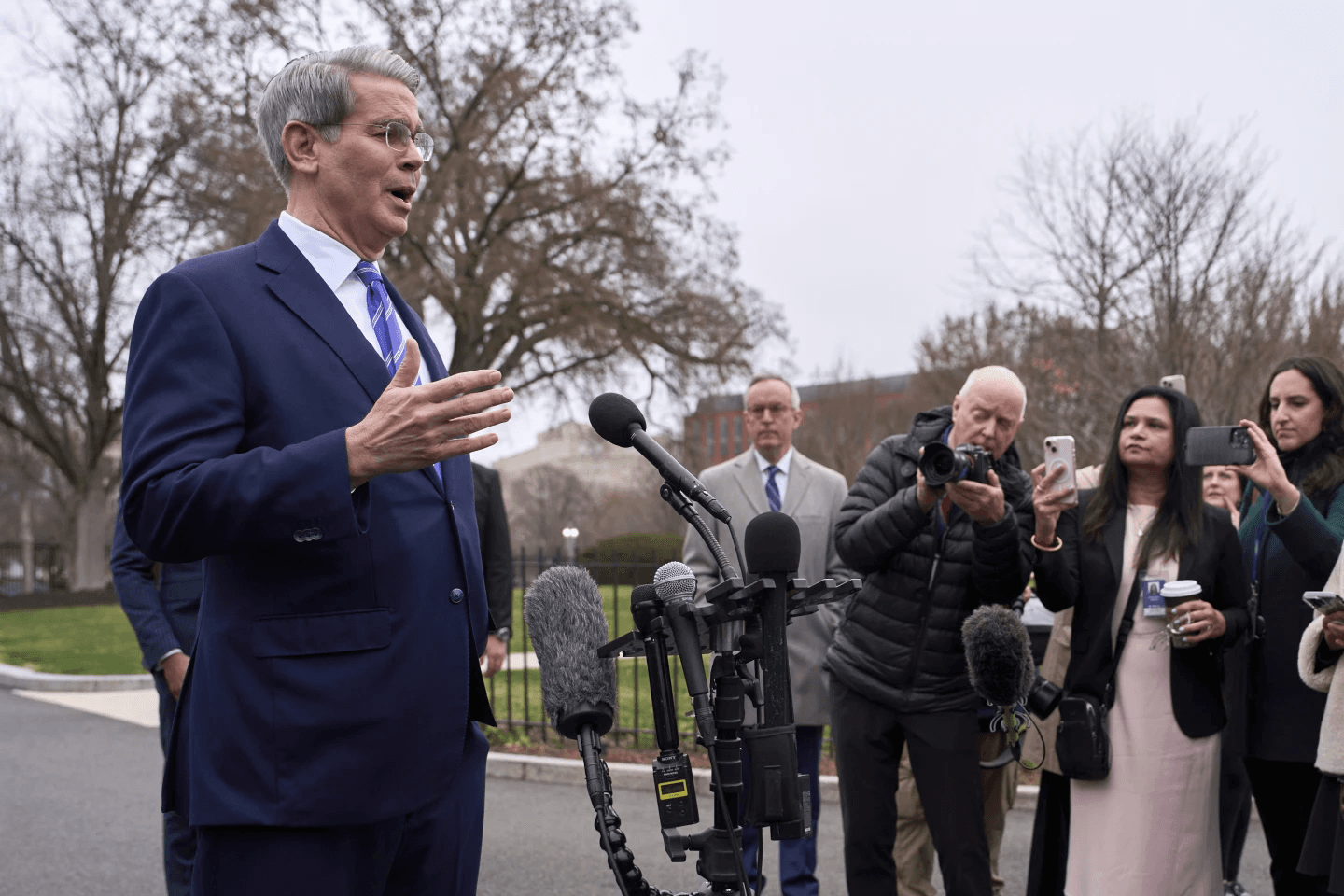

Still, the report’s warnings and its projections for the future also set the stage for the challenges on the debt, government spending and economic growth that Treasury Secretary Scott Bessent insists the Trump administration can fix.

Bessent has advocated for a “3-3-3” plan, which involves getting the federal budget deficit down to 3% of GDP, boosting inflation-adjusted annual GDP growth to 3% and producing the equivalent of an additional 3 million barrels of oil per day by 2028.

The treasury secretary has sought to discredit CBO scoring, calling it “crazy.”

“I was in the investment business for 35 years, I thought I understood how crazy CBO scoring is,” Bessent told CNBC earlier this month. “And now that I’m on the other side of the wall, I can tell you it’s really crazy. And very unlikely that we are going to get any credit in the CBO scoring for tariffs.”

However, CBO warnings about population growth cut into Trump administration policy priorities related to mass deportations, as officials claim that immigrants are fueling high inflation by worsening the housing shortage and depriving U.S. citizens of job opportunities.

A decreasing population could have profound negative effects on the economy, as growth depends on adding workers as well as increasing their productivity. Falling population levels could cause a stagnation in living standards and create difficulties in paying down debts as well as funding programs such as Social Security, which is dependent on payroll taxes.

The report also comes as the U.S. is on track to hit its statutory debt ceiling — the so-called X-date when the country runs short of money to pay its bills — as early as August without a deal between Congress and the White House.

The CBO and the Bipartisan Policy Center this week detailed projections for the U.S. to hit its statutory debt ceiling sometime this summer — as soon as July or August, respectively.

Michael Peterson, CEO of the Peter G. Peterson Foundation —which among other things tracks the federal debt— said in a statement that “as bad as this outlook is, it represents an ‘optimistic scenario,’ because policymakers are currently considering adding trillions more in tax cut extensions, which would add to the debt.”

© 2025 iTrader Global Limited | Company registration number 15962

iTrader Global Limited is located at Hamchako, Mutsamudu, Autonomous Island of Anjouan, Union of Comoros, The Comoros and is licensed and regulated by the Securities Commission of the Comoros. Our license number L15962/ ITGL

iTrader Global Limited, operating under the trading name “iTrader,” is authorized to engage in Forex trading activities. The company’s logo, trademark, and website are the exclusive property of iTrader Global Limited.

Risk Warning: CFD trading carries a high risk of rapid capital loss due to leverage and may not be suitable for all users.

Trading in funds, CFDs, and other high-leverage products requires specialized knowledge.

Research indicates that 84.01% of leveraged traders incur losses. Please ensure you fully understand the risks and are prepared to lose your capital before engaging in leveraged trading.

iTrader hereby states that it will not be held fully responsible for leveraged trading risks, losses, or other damages incurred by any individual or legal entity.

The news and information provided on this website are for educational purposes only. Users should make independent and informed financial decisions.

Restrictions: iTrader does not direct its website or services to residents of countries where such activities are prohibited by law, regulation, or policy. If you reside in a jurisdiction where the use of this website or its services is restricted, you are responsible for ensuring compliance with local laws. iTrader does not guarantee that the content of its website is appropriate or lawful in all jurisdictions.

iTrader Global Limited does not provide services to citizens of certain countries, including (but not limited to): the United States, Brazil, Canada, Israel, and Iran.