2025-04-02

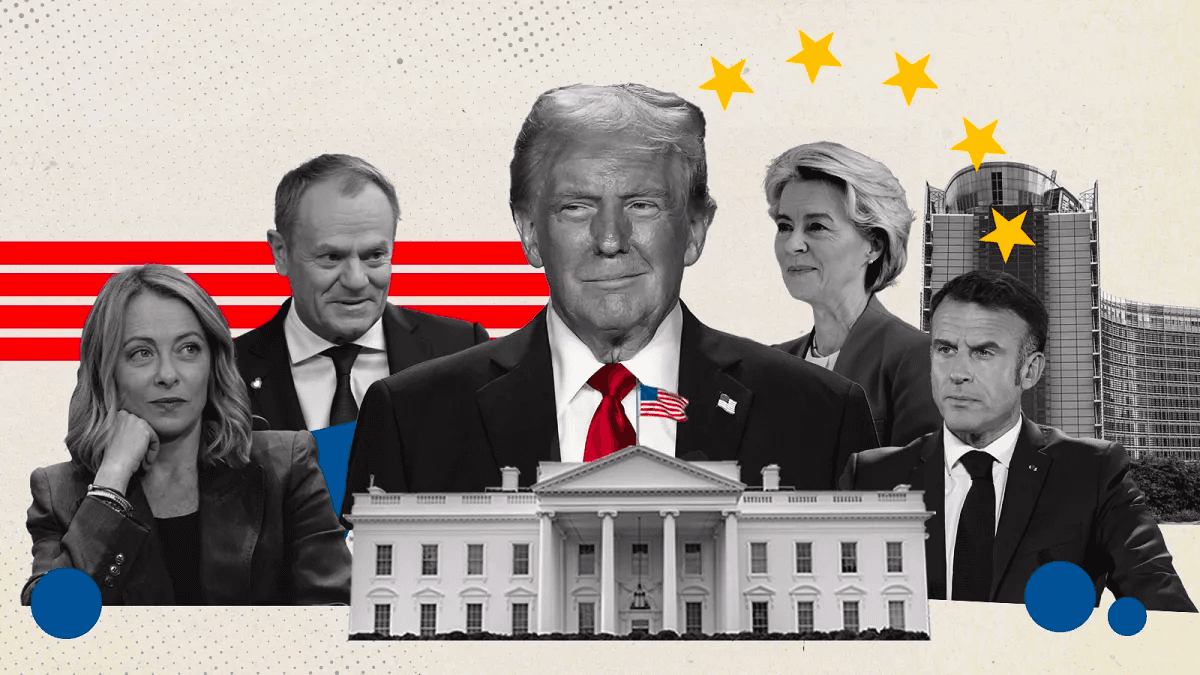

Eurozone inflation numbers are unlikely to move the short end of the euro curve by much as tariff threats loom. Markets are too focused on the near term to care about headlines that Le Pen is barred from running for President in 2027. Meanwhile, Treasuries are hooked by 2 April and what it might imply. The risk asset reaction will decide the impact outcome

The eurozone inflation numbers are coming in just a day before Trump’s tariff announcements. With risk sentiment deteriorating over the past week, markets have been keen to price in a European Central Bank landing point of 1.75% again, after hugging closer to 2% for most of this month. But to break sustainably below 1.75% seems more difficult and hasn’t happened yet this year. The ECB has also given pushback against more easing by making clear that it doesn’t intend to cut into expansionary territory.

In addition, with increased EU spending in the pipeline, we don’t think an undershoot in inflation numbers would be enough to break outside of the 1.75-2% range for the ECB’s landing zone. Consensus sees a 2.5% year-on-year core CPI reading and plenty of economists see 2.4% as a possibility. After German inflation numbers came in below expectations earlier, however, markets should already be positioned for a lower reading. The upside to the short end of the curve from a higher-than-expected reading is also limited as looming tariffs will continue to weigh on sentiment.

Le Pen being barred from the next presidential elections in 2027 was the big headline from France, but French government bonds remained relatively unfazed. In our view the news has a significant weight as Le Pen would have been a serious contender to follow up Macron. One could argue that Le Pen’s court ruling reduces the chances of a more populist direction in the future, which should be seen as favourable from a fiscal perspective.

On the other hand, we also understand that the market’s focus is elsewhere, with Trump’s upcoming tariff announcement taking centre stage. The 10Y OAT-Bund spread actually traded 1bp wider than before the weekend as risk sentiment worsened. And of course the court ruling is just a small detail in the complex and fragile fiscal situation France is in. The economic risks in the near term simply take priority over an election that likely won’t take place for another two years.

Treasuries have, in part, struggled to get a handle on the implications of a tariff wall around the US. That said, the net impact of the growing tariff talk has been towards lower yields. But then again, the rates market is not discounting a recession. By implication, tariffs are not good, but at the same time, seemingly not bad enough to tip the economy into recession. Interest rate cuts are discounted, some 75bp of them. But the funds rate is still discounted to floor at or around 3.5%. That's not in tune with a recession. It's more in tune with damage limitation, and a growth recession (growth at less than trend, but still growth). If Treasury yields are going to gap lower, it likely requires the discount for more rate cuts than we currently have. If we don't get that, then Treasury yields are likely too low already.

The big day is Wednesday, and reaction to it. We've been range trading so far in the past number of weeks; little reason to change that ahead of Wednesday. On Wednesday itself, there is rationale for yields to move in either direction, but given the current mood music there is a bigger downside than upside risk, at least as an impact reaction. That is unless the outcome feels less bad than anticipated. Initially, Treasuries will react to how risk assets take the news. Take it well, and Treasury yields then rise. Take it badly, and it's the opposite.

Source: https://think.ing.com/articles/rates-spark-market-rates-getting-tempted-lower/

© 2025 iTrader Global Limited | Company registration number 15962

iTrader Global Limited is located at Hamchako, Mutsamudu, Autonomous Island of Anjouan, Union of Comoros, The Comoros and is licensed and regulated by the Securities Commission of the Comoros. Our license number L15962/ ITGL

iTrader Global Limited, operating under the trading name “iTrader,” is authorized to engage in Forex trading activities. The company’s logo, trademark, and website are the exclusive property of iTrader Global Limited.

Risk Warning: CFD trading carries a high risk of rapid capital loss due to leverage and may not be suitable for all users.

Trading in funds, CFDs, and other high-leverage products requires specialized knowledge.

Research indicates that 84.01% of leveraged traders incur losses. Please ensure you fully understand the risks and are prepared to lose your capital before engaging in leveraged trading.

iTrader hereby states that it will not be held fully responsible for leveraged trading risks, losses, or other damages incurred by any individual or legal entity.

The news and information provided on this website are for educational purposes only. Users should make independent and informed financial decisions.

Restrictions: iTrader does not direct its website or services to residents of countries where such activities are prohibited by law, regulation, or policy. If you reside in a jurisdiction where the use of this website or its services is restricted, you are responsible for ensuring compliance with local laws. iTrader does not guarantee that the content of its website is appropriate or lawful in all jurisdictions.

iTrader Global Limited does not provide services to citizens of certain countries, including (but not limited to): the United States, Brazil, Canada, Israel, and Iran.